For a long time, online payments were viewed as a cost center, a necessary evil to keep businesses running. But that mindset is shifting.

More businesses are thinking strategically about payments—and realizing their legacy stack is holding them back. Scaling across markets, adding new payment methods, or switching providers shouldn’t take months of engineering work. Yet for many, it still does.

This article unpacks why payment orchestration is one of the fastest-growing areas in fintech—and how it’s helping merchants simplify complexity, boost performance, and unlock growth.

But first, some background

To write about this 25 years ago would’ve been pretty strange, as it was commonplace for merchants to be connected to multiple payment processors. So, what happened over that period to take us full circle?

As the internet boomed, online businesses were forced to partner with multiple payment processors globally to serve new customers they were able to attract. Typically, they’d do this by integrating what’s known as a payment gateway.

A payment gateway establishes and certifies tens or hundreds of processor connections worldwide. This provided merchants with extensive coverage, but the payment gateways were built on technology from the 1980s, which was not particularly well-suited to scaling online businesses.

That opened the door for a new wave of API-first platforms, such as PayPal, Stripe, and Adyen. These companies bundled modern gateways with acquiring services, offering merchants a clean, developer-friendly interface and a single provider for all things payments. It solved real problems and quickly became the gold standard.

This approach was so successful that it helped drive a boom in fintech innovation. Now, there are far more features, locations, and payment options available to merchants than any single all-in-one solution could possibly keep up with.

So merchants started piecing together their own setups again: adding processors, integrating fraud tools, and building out coverage themselves.

Sound familiar? We’ve come full circle—but this time, with a lot more complexity.

Each new integration requires upfront development costs and ongoing maintenance, as well as new processes and operational tasks to implement. Merchants are deterred from entering new markets or testing new payment methods, as the barrier to entry is simply too high.

A new hope: payment orchestration

Enter payment orchestration.

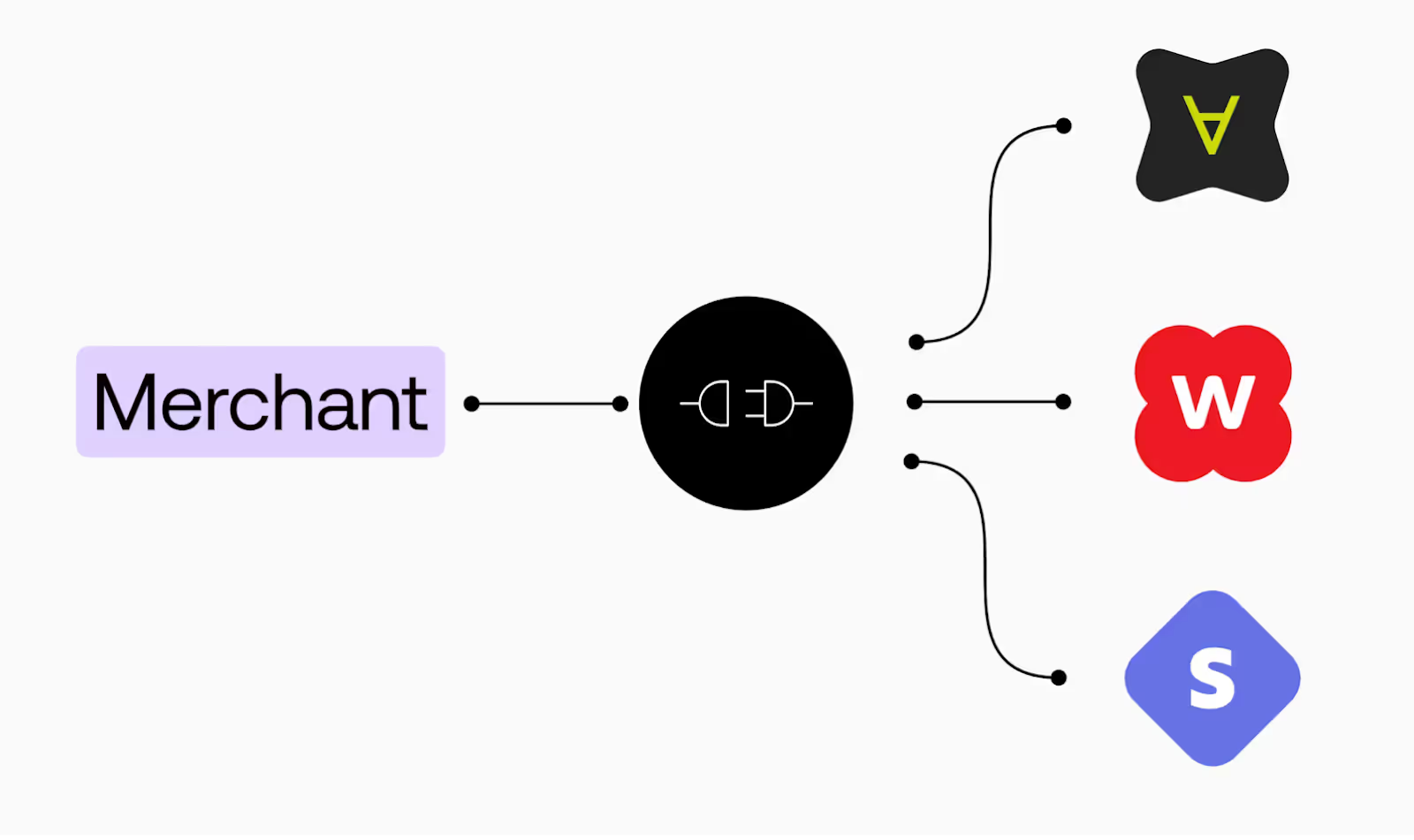

Orchestrators connect to hundreds of processors, gateways, and payment methods through a single API, providing merchants with a faster and more flexible way to expand into new markets, test local payment options, and build resilience into their stack.

Payment orchestrators establish connections with hundreds of processors and payment methods through a single API, enabling merchants to quickly enter new markets and test new payment methods.

The rise of payment orchestrators has enabled merchants to offload some of their development costs and helped even the smallest businesses build a complex payment stack.

But this still doesn’t answer why merchants need this. Why not wait for your current processor to add support for these new capabilities?

There are four key reasons to consider using a payment orchestrator over a single processor:

1. Speed to market: payment orchestrators can move faster

The new breed of payment processors moves quickly, but they still want to maintain that all-in-one offering. That means when they add a new payment method or enter a new region, they have to build everything—from onboarding and compliance to fund flows and reporting. It’s a significant undertaking, and it requires time.

Payment orchestrators don’t face the same constraints. Since they typically don’t touch the money, they’re not burdened by the same regulatory overhead. They can move fast, like a merchant would, except that building payment features is all they do.

2. Redundancy: no reliance on a single payment processor

Even if businesses were happy to wait and watch their competition steal a march by attracting new customers to their platform (they’re not), they’d still be 100% dependent on a single payment processor.

If we take another brief history lesson: Less than 15 years ago, nearly every business built and maintained its own server infrastructure. There were multibillion-dollar companies with a single point of failure in their business, or who’d need to fail over to their backup server manually.

This seems archaic now. With the rise of AWS and cloud infrastructure, failover occurs automatically, latency is minimized by routing through local regions, and no one is building it all from scratch.

Payments should be no different.

Every second matters during a payment outage. That’s why smart merchants are connecting to multiple processors through orchestration platforms with built-in redundancy, allowing them to reroute transactions instantly without interruption or delay.

3. Keep more revenue from payments

There’s no shortage of excellent payment processors—Stripe, Adyen, Worldpay, Mollie, Braintree, and many others. But none of them are perfect everywhere.

Each has its strengths and trade-offs depending on the region, card type, customer segment, or even the time of day. That’s why leading merchants use multiple processors and closely monitor performance across all of them to spot areas for improvement.

At the enterprise level, some teams have dozens (or even hundreds) of people dedicated solely to this task. Why? Because even a small uptick in approval rates or a slight drop in fees can add up to millions in revenue.

Historically, these gains were only accessible to the biggest players: those who could afford the engineering and analytics effort. But with payment orchestration, any merchant can access this same level of optimization.

No code. No custom builds. Just smarter routing and better outcomes.

4. Payment orchestration helps reduce operational risk

One of the worst things that can happen to a fledgling business is to be hit by a sophisticated fraud attack, not only due to the financial impact, but also the reputational damage. To make matters even worse, processors have been known to close accounts with little warning to businesses that have fallen victim to these attacks or those operating in a high-risk industry.

In moments like this, having the ability to spin up a new processor and reroute transactions instantly, without writing a line of code, can be the difference between recovery and collapse.

Payment orchestration gives you that flexibility. It also helps reduce the risk of ever getting to that point. With orchestration, you can plug in leading fraud prevention tools that work across any processor, so you’re not locked into one provider’s native solution. That means stronger protection, greater resilience, and a far more robust payments setup.

Find out if your business needs a payment orchestration platform.

How to choose the right payment orchestration platform

There are four important criteria to consider when selecting a payment orchestration solution for your business:

- A low-code approach

- Unified data

- PCI and vaulting

- Operational support

Let’s go through each one. We’ll also show you how we meet these criteria at Primer.

1. A low-code approach

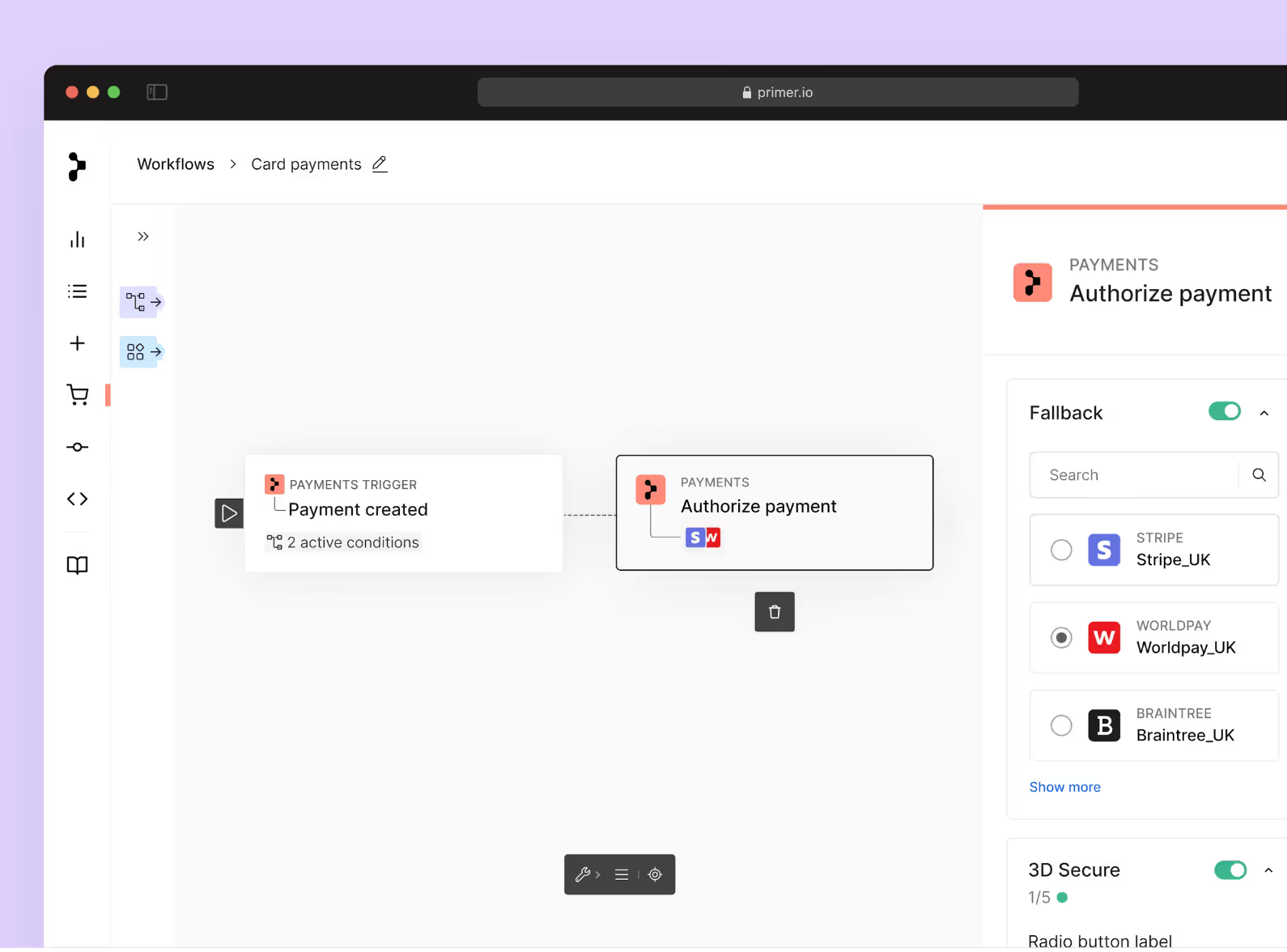

Choosing a partner that supports all the payment processors and payment method connections you need is only half of the battle. If you’ve integrated with the payment orchestrator, but then need to maintain complicated business logic to switch traffic between processors, you’re only shifting the problem to another team.

Ensure that the partner offers low-code routing logic and that you can reap the benefits of payment orchestration without needing to plan your engineering roadmap for each update.

With Primer

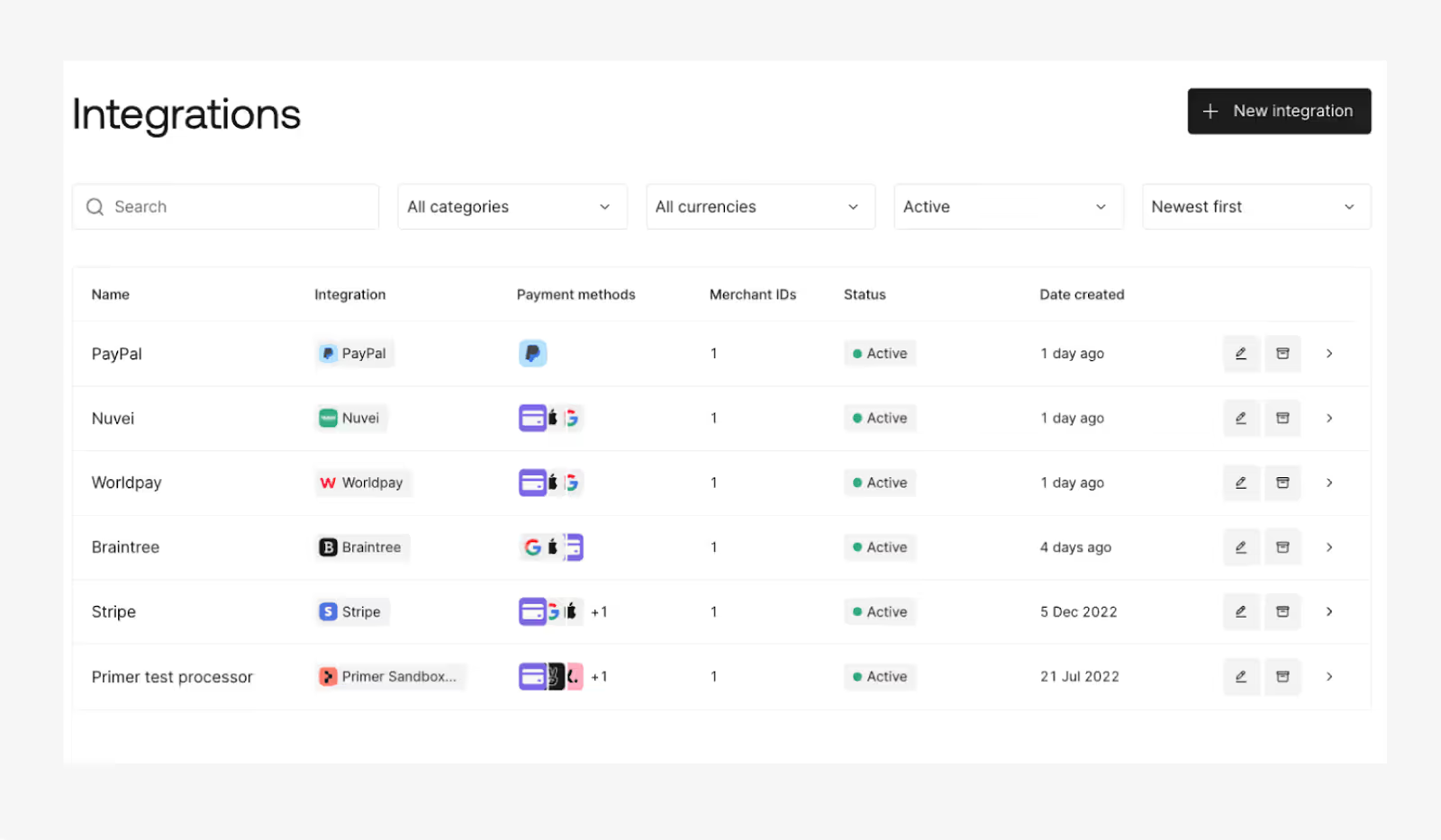

Adding a new payment processor is a simple process that takes just a few clicks.

Simply:

1. Find the integration you want

2. Add it to your payment stack

3. Add alternative payment methods.

And that’s it.

Integrating with new payment methods is a similar process. For example, say you want to start operating in Singapore. You’ll need to offer PayNow as a payment option if you're going to compete, as over half of all Singaporeans use it as their primary payment method. With Primer, you don’t need to worry about using up engineering resources to integrate this.

Managing your available payment methods is simple using our codeless Universal Checkout. You can control which options appear at checkout based on factors such as customer location or basket contents, all without writing a single line of code. It’s a faster, smarter way to deliver a localised, optimised payment experience at scale.

Primer in action: Ferryhopper

With Primer, Ferryhopper was able to add new processors and payment methods in a few clicks, without burdening their lean team. Instead of building and maintaining connections themselves, they tapped into Primer’s pre-built integrations and low-code workflows to orchestrate payments across 12 countries and 5 PSPs.

Read more: Charting a new course for payments at Ferryhopper

2. Unified data

Once you’ve found a solution that can support no-code payment routing, make sure to assess whether it provides a unified view of your data. Can you access payment data in your own data warehouse to gain insights? Or better yet, can the solution provide reporting into payment performance across all your processors and payment methods from the same orchestration platform?

Without access to detailed insights on your payment data, you’ll be attempting to orchestrate payments with a blindfold on.

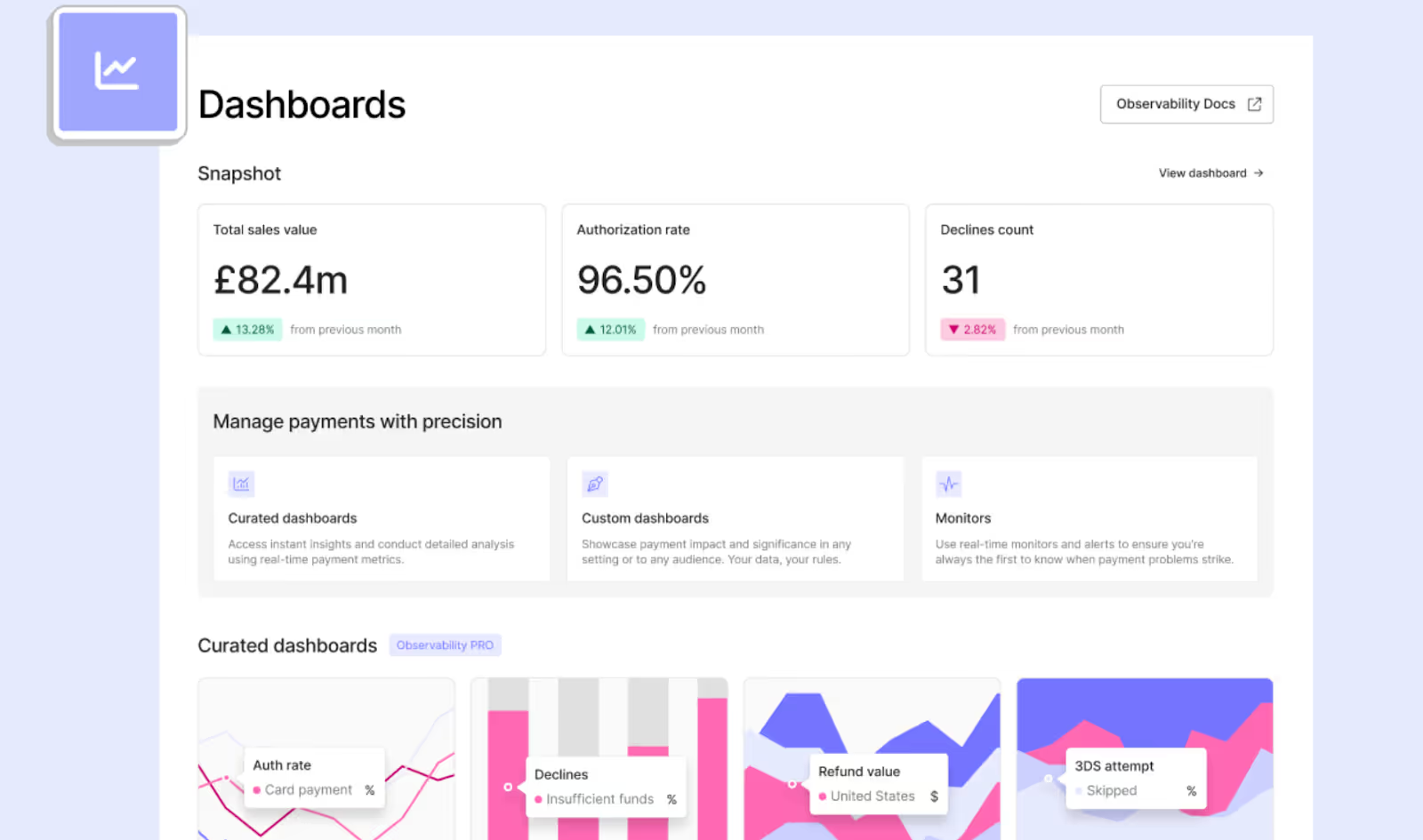

With Primer:

Primer brings together every payment event across your processors, payment methods, and markets into a single, intuitive space: the Observability Dashboard.

You can visually track the full payment journey using a layered Payment Timeline view, which clearly displays key events (authentication, 3D Secure, retries, and declines) and highlights where drops occur. This visual clarity enables teams to quickly debug and optimize flows without needing to delve into raw logs or rely on engineering support.

Want to know why authorization rates dipped in Germany last week? Or how a specific payment method is performing in APAC? It’s all filterable and explorable by processor, method, region, or even customer segment.

To help stay ahead of issues, Primer also offers Monitors: custom, real-time alerts (via email or Slack) that notify you of anomalies or drops in key metrics, such as success rates, retries, or authentication declines. Monitors are configurable by payment method, geography, and processor, allowing your team to act proactively before a dip turns into a revenue loss.

Primer in action: Cleeng

As Cleeng expanded into new regions, its single-processor setup began to fall short, especially when regional formatting issues led toa decline in transactions. With Primer, Cleeng gained a unified view of payment performance across processors and markets, along with tools to adapt in real time.

Read more: How Cleeng and Primer are powering the future of subscription payments for D2C

3. PCI & vaulting

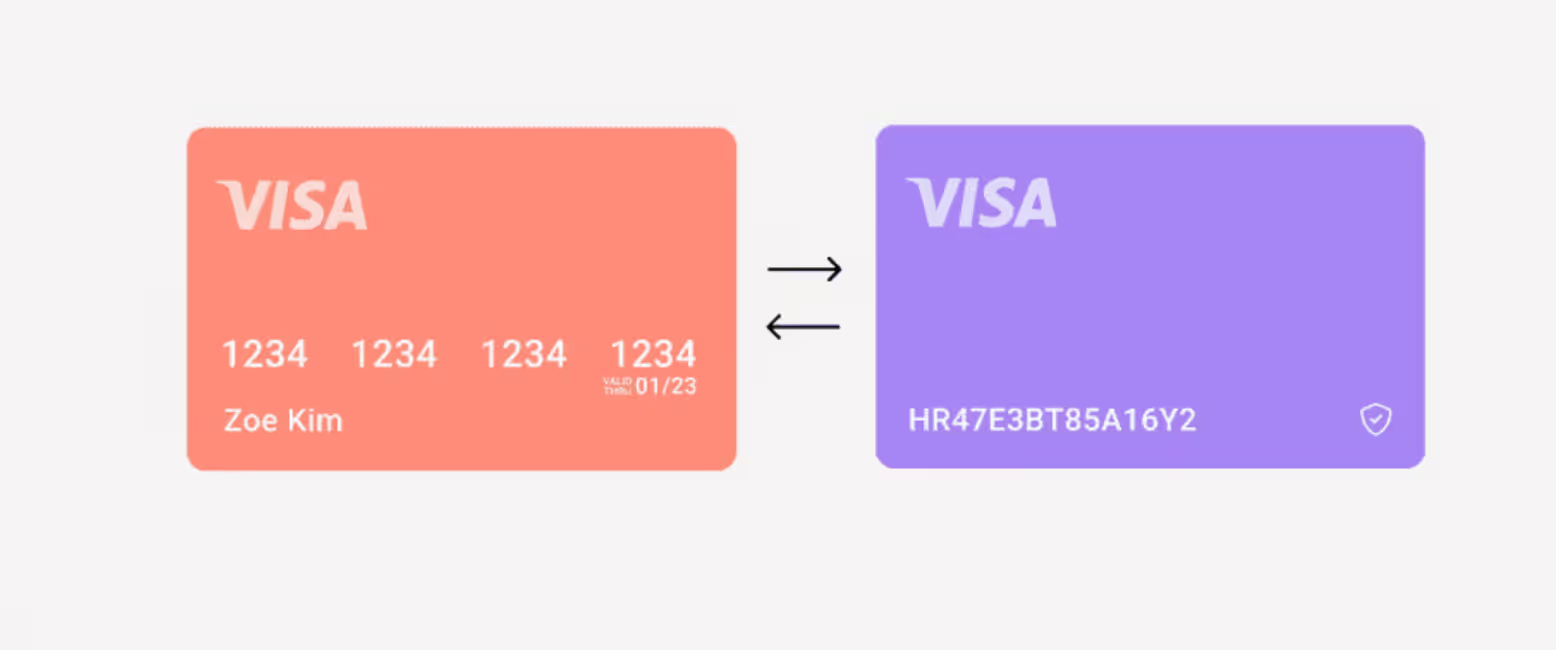

One of the significant benefits of payment orchestration is the ability to enable redundancy and optimized routing across multiple processors. To achieve this, you need a solution that is PCI DSS Level 1 compliant and can securely vault payment method tokens independently of any single processor.

If tokens are stored with a payment processor, they are often locked to that processor’s environment. This means they typically cannot be reused with another provider, limiting your ability to reroute transactions in the event of an outage or to optimize for performance or cost.

With Primer:

Primer is PCI DSS Level 1 certified and offers a processor-agnostic, centralized token vault that provides full control over your customers’ stored payment methods, eliminating the need for you to manage PCI compliance independently.

With Primer’s Agnostic Vault, you’re not tied to a single payment service provider. Tokens can be reused across any connected processor, so if one provider goes down or underperforms, you can reroute transactions instantly, with no disruption to your customers and no lost revenue.

Primer also supports network tokenization via Visa and Mastercard, which replaces sensitive card data with a secure, updatable token issued by the card network. If a card is reissued or expires, the token can be automatically updated, helping to reduce involuntary churn and ensuring recurring payments continue uninterrupted.

It’s not just safer, it’s smarter: network tokens can lead to higher authorization rates and may qualify for lower interchange or processing fees, depending on the network and region.

4. Operational support

If you’re a developer, product, or payments manager reading this, payment orchestration may sound like the answer to all your problems. However, if you’re a finance or operations manager, you’re likely starting to worry about how you’ll manage all the new workflows introduced as more payment processors and methods are supported.

The essential solution? Finding a tool that’s able to offload these challenges as well. Does the payment orchestration platform provide a unified reconciliation format or a single view of disputes across all your payments? Can the orchestrator sync data to third-party ERP and accounting tools? If the answer to these is no, adding new payment processors and methods won’t be an easy feat.

With Primer:

Primer is designed to make scaling your payments stack seamless, not just technically, but operationally as well. Finance and operations teams gain the same unified visibility as engineering and product teams, with tools purpose-built to reduce manual overhead and complexity.

Instead of reconciling reports from multiple PSPs, Primer provides a standardized reporting layer that consolidates settlements, transaction fees, refunds, and chargebacks into a consistent format, ready for downstream systems. That means less time wrangling data and more time driving strategy.

Primer in action: Maisons du Monde

With plans to expand its range of payment methods and processors across Europe, ecommerce brand Maisons du Monde faced mounting operational challenges, especially around reconciliation and reporting across multiple providers.

By choosing Primer, the team was able to streamline these workflows without growing their payments team. Primer standardizes reporting across providers, simplifying reconciliation and reducing the manual effort needed to support a more complex payment stack. This enables Maisons du Monde to scale its operations and payment options while maintaining a focus on delivering a seamless user experience.

Read more: Maisons du Monde redesigns its payments with Primer

Use Primer to build an optimized multi-processor strategy

Large companies have the resources to add, build out, and maintain payment processor integrations on their own, but this still usually involves large teams (of up to hundreds) to manage.

Forget the costly development resources, slow payment roadmaps, and increasing anxiety of keeping up as innovative payment solutions are introduced every day. The right payment orchestration platform can now enable any business to have this same level of detail when it comes to payments and help futureproof your payment systems for years to come.

Interested in learning more about payment orchestration and how using the right platform can continuously optimize your business and improve your customer experience?

Get in touch with our experts to learn more about how Primer can help, as well as pricing.